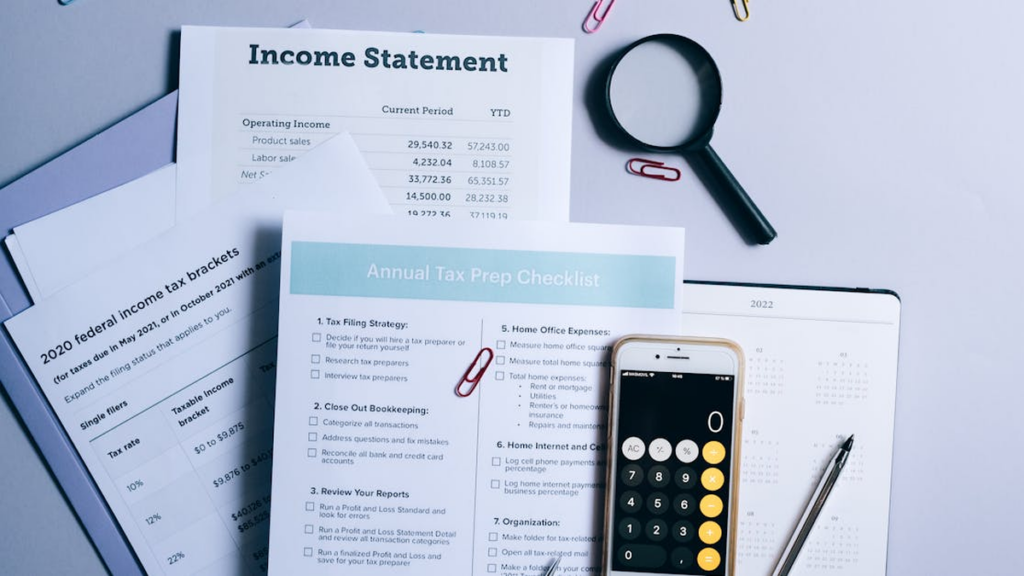

Decoding income definitions: AGI, MAGI, and taxable income explained

Navigating the U.S. tax system can be complex, particularly when understanding critical concepts like Adjusted Gross Income (AGI), Modified Adjusted Gross Income (MAGI), and Taxable Income. These definitions impact your tax liability and eligibility for various deductions and credits, playing a pivotal role in financial planning. Empower yourself with the knowledge to make informed tax decisions by decoding these essential terms in our latest article.

Decoding income definitions: AGI, MAGI, and taxable income explained Read More »